November 7, 2025

Getting Started with Net-Net Investing

The 24% 'Cigar-Butt' Secret: Getting Started with Net-Net Investing

What if there was a way to invest that didn't involve deciphering complex growth projections, betting on the "next big thing," or anxiously watching every market fluctuation? What if, instead, you could use a simple, mechanical strategy so powerful that it was championed by Benjamin Graham, Warren Buffett's mentor, and has been shown to historically outperform the market by a stunning margin?

Welcome to the world of net-net investing.

This isn't just another theory. Rigorous backtesting of this strategy has shown average annual returns of 24%, consistently dwarfing the S&P 500's historical average of around 14%.

It's a strategy built on one irresistible idea: buying a dollar's worth of assets for 50 cents.

What is a "Net-Net" Stock?

Benjamin Graham famously called these opportunities "cigar-butt" stocks. You find a cigar on the street, seemingly worthless, but it has one good puff left in it. That puff is pure profit.

In the stock market, a "net-net" is a company trading for less than its liquidation value. We calculate this using a simple, ultra-conservative formula called Net Current Asset Value Per Share (NCAVPS).

NCAVPS = (Current Assets − Total Liabilities) / Shares Outstanding

This formula completely ignores long-term assets like buildings and equipment. It focuses only on the easy-to-sell stuff: cash, receivables, and inventory. If a company's stock price is below its NCAVPS, you're theoretically buying it for less than its spare parts.

The problem? Finding these gems is like panning for gold. It requires sifting through thousands of companies and manually digging through balance sheets. It's time-consuming, tedious, and overwhelming.

Until now.

Your Unfair Advantage: The Net-Net Screener

This is where NetNetScreener.com transforms a powerful but difficult strategy into an effortless process. We do the heavy lifting for you, turning hours of research into seconds of discovery.

When you log in, you're greeted with the Screener—your command center for finding deep value.

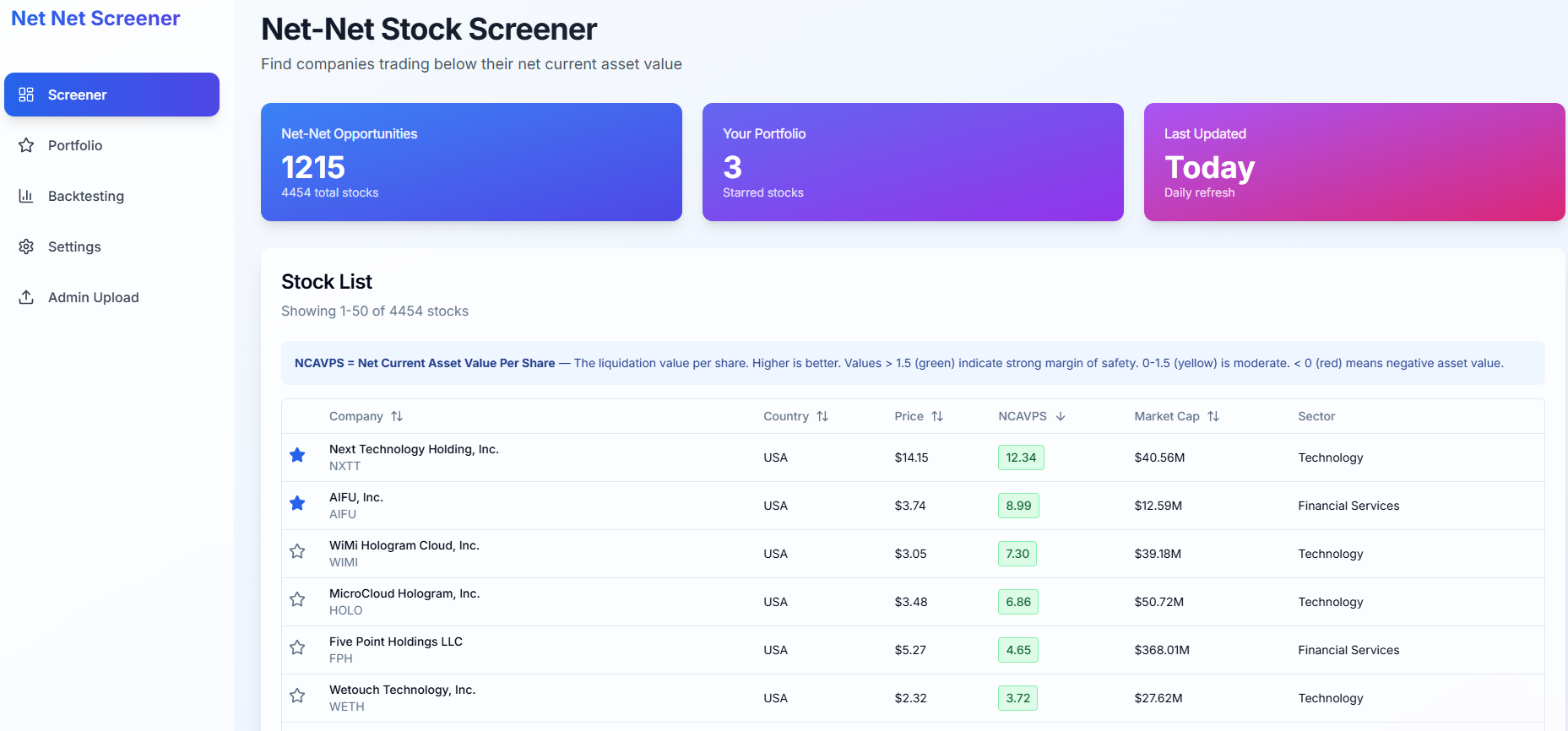

Instantly, you see a universe of opportunities. In this view, our system has identified 1,215 potential net-net stocks out of thousands. No more guesswork. No more manual calculations.

The Screener: Your command center for discovering deep value opportunities

The Screener: Your command center for discovering deep value opportunities

Notice the NCAVPS column. This is your magic number. The higher it is relative to the price, the bigger your margin of safety. We even color-code it for you: bright green signifies a deep discount and a strong potential opportunity. You can sort by the highest NCAVPS, country, or market cap to instantly narrow down the list to fit your exact criteria.

Your Simple, Emotion-Free Action Plan

"Okay," you're thinking, "I see the list. Now what?"

This is the beauty of a systematic approach. You don't need to be a Wall Street guru. You just need a simple, repeatable plan.

Step 1: Screen & Star

Scroll through the Screener. See a company with a high NCAVPS that looks interesting, like Next Technology Holding, Inc. (NXTT) with an incredible NCAVPS of 12.34? Simply click the star icon.

Step 2: Build Your Portfolio

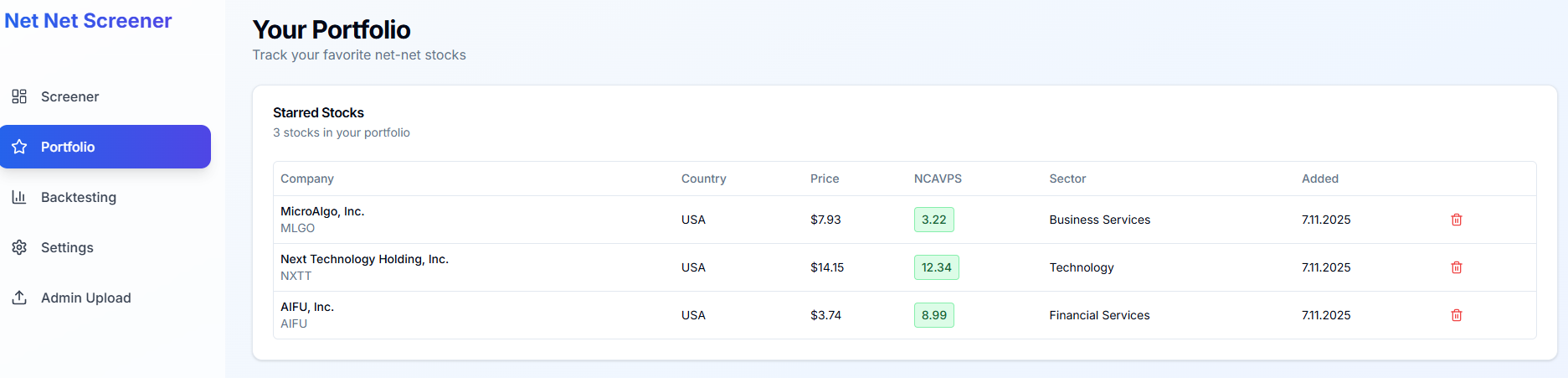

Every stock you star is automatically added to your personal Portfolio page. This is your watchlist—a clean, simple dashboard to track the opportunities you've handpicked.

Your Portfolio: Track your handpicked net-net opportunities

Your Portfolio: Track your handpicked net-net opportunities

Here, you can monitor your selections without the noise of the main screener, keeping an eye on their price and NCAVPS.

Step 3: Define Your Exit & Execute

The key to this strategy is removing emotion. You buy based on data, and you sell based on data. A proven method is:

- Buy: Purchase a basket of stocks trading at a deep discount (e.g., Price is less than 50% of the NCAVPS).

- Sell: When the market recognizes the value and the stock price rises, the discount shrinks. You automatically sell when the price reaches a predefined level, for instance, when it is no longer below 50% of its NCAVPS (or NCAVPS < 0.5).

- Repeat: Take your profits and head back to the Screener to find the next deeply undervalued company.

This is the "rinse and repeat" cycle. It's simple, but it's not easy. It requires discipline. But with our tools, the most difficult part—finding and tracking the opportunities—is done for you.

Stop Guessing, Start Winning

Net-net investing is a proven, backtested strategy for beating the market. It's a logical, business-like approach that strips away emotion and focuses on one thing: buying assets for far less than they are worth.

With NetNetScreener.com, you no longer need to spend your weekends buried in financial reports. You have a powerful, intuitive tool that delivers actionable opportunities directly to you.

The 24% returns of this strategy are no longer just a historical footnote. They are a tangible goal. The tools are here. The opportunities are waiting.